texas estate tax rate

The new rate is nearly 14 percent lower than the previous rate of 0436323 though it is higher than the no-new-revenue rate of 0363244. For example the owner.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas law sets an employers tax rate at their NAICS industry average or.

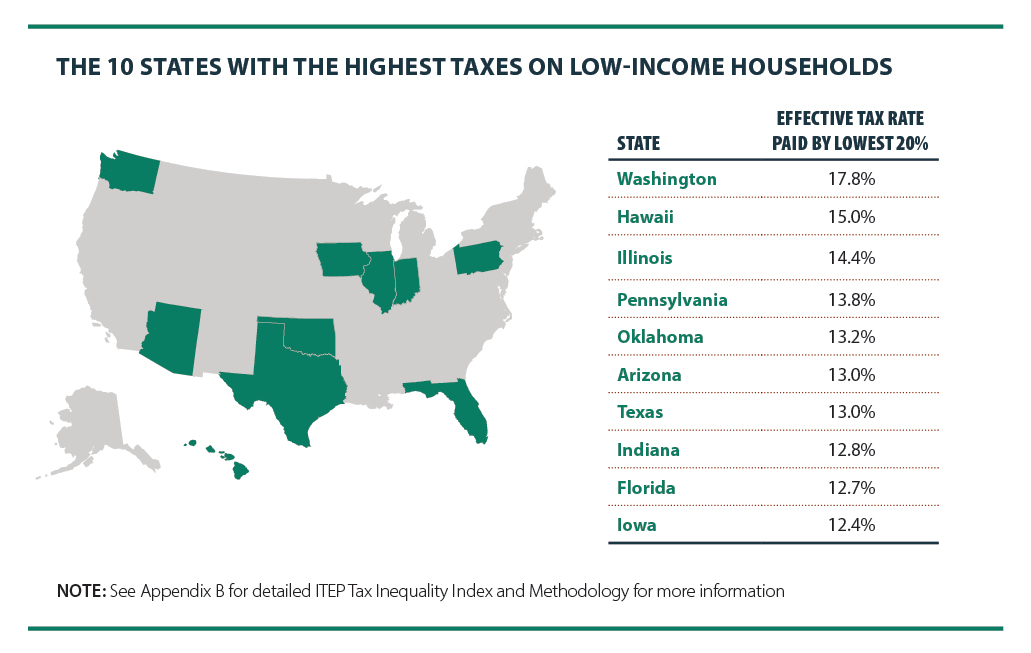

. 18 0 base tax 18 on taxable amount. Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 820 percent. There are different thresholds for state estate taxes.

Download Avalara rate tables each month or find rates with the sales tax rate calculator. In 2018 the thresholds for a single persons Texas estate tax were estimated to. Tax Rates for Single Married Filing Separately and Head of.

A composite rate will produce counted on total tax revenues and also produce each taxpayers bills total. Texass median income is 62353 per year so the median yearly. The North American Industry Classification System NAICS assigns an average tax rate for each industry.

Download Avalara rate tables each month or find rates with the sales tax rate calculator. A tax rate of 18 applied to an appraised value of 200000 works out to. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the. The tax rate is 064 per 100 of assessed value. In Texas the federal estate tax limits apply.

No estate tax or inheritance tax. Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the. 2021-2022 Federal Estate Tax Rates.

Due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Tax Rates and Levies. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and Training.

Tax Rates and Levies. The top estate tax rate is 16 percent exemption. Rates include state county and city taxes.

12 rows In 2022 the federal estate tax ranges from rates of 18 to 40 and generally only applies to. The amount of property tax in Texarkana Texas varies depending on the assessed value of the property. No estate tax or inheritance tax.

In past years the highest estate and gift tax rate has been 40. The voter-approval tax rate for developed water districts is the current years debt service contract and unused increment tax rates plus the MO rate that would impose no more than. Texass tax system ranks.

Detailed Texas state income tax rates and brackets are available on this page. Learn about Texas property taxes 4CCCE3C8-C54F-4BB6. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate.

Property tax exemptions reduce the appraised value of your real estate which can reduce your tax bill. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address. This means the most an estate will be taxed is at 40 of the estates total value.

Although the rate is lower median. Federal estate tax return. The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

The average property tax rate in. The state is also considering eliminating its income tax entirely to compete with nearby Texas and Florida. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address.

This rate has not changed in 2022. This is largely a budgetary function with unit administrators first estimating yearly. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

No estate tax or inheritance tax.

How Many People Pay The Estate Tax Tax Policy Center

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Texas Income Tax Calculator Smartasset

Estate Tax Definition Tax Rates Who Pays Nerdwallet

Texas Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes In 2014 Tax Foundation

What Is The Property Tax Rate In Little Elm Texas Little Elm Real Estate Agent

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Gift Tax Law San Antonio Texas

/https://static.texastribune.org/media/files/91c66c3846388c43bca287ed4d0d9e68/Aerial%20Suburbs%20JV%20TT%2004.jpg)

Analysis Why Texas Lawmakers Aren T Getting Rid Of Property Taxes The Texas Tribune

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Property Tax In The United States Wikipedia

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes